Within the memory sector, news has been rife with articles surrounding Samsung’s reduction in integrated circuit (IC) manufacturing.

But what does this really mean for the market and ultimately the consumer? 6 months on from the initial stories, we asked Francesco Rivieccio, Director of Memory Products at Integral to help fill us in.

Francesco, can you briefly explain the background to this story?

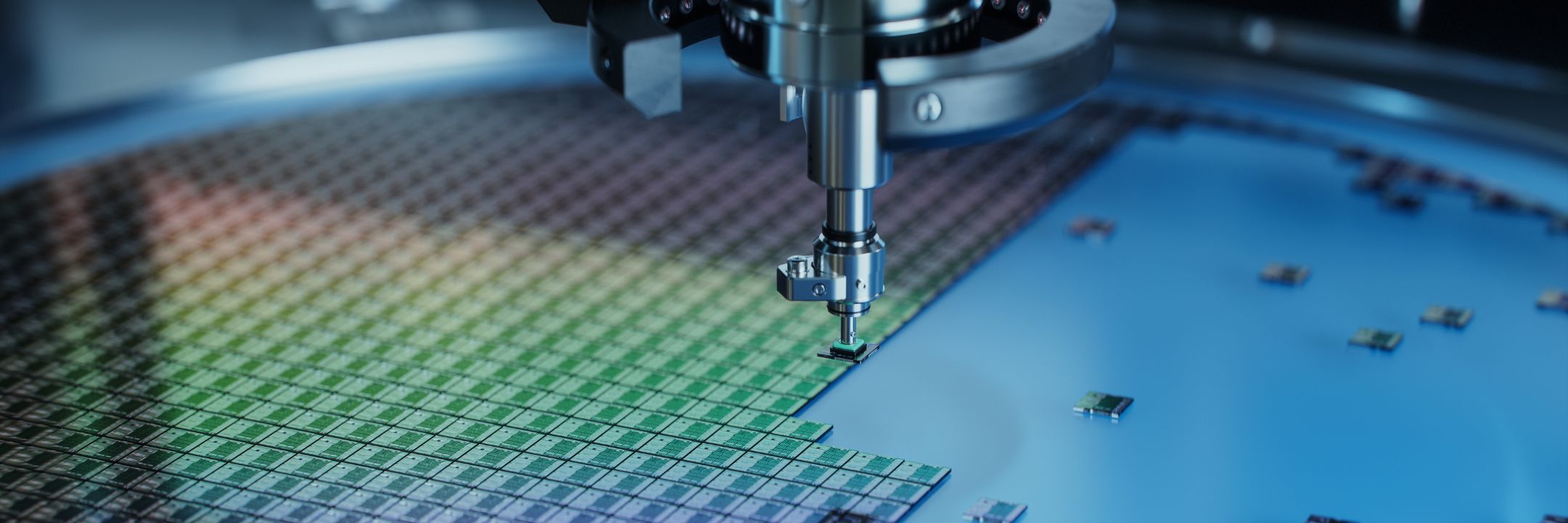

To understand what’s going on with Samsung and IC fabrication, first you need to understand the lifecycle of semiconductor manufacturing.

Semiconductor technology is constantly evolving. As the technology advances, chips get smaller increasing the amount of chips that can be made from a single wafer, speed and capacity improve and ultimately prices come down.

Semiconductors have a long manufacturing cycle so to keep up supply manufacturers run plants constantly. If there is a decline in demand, this leads to a stockpile of chips which manufacturers need to shift. Inevitably if this trend continues manufacturers must cut prices to try and sell their overstock, which in turn leads to profit losses and production cuts.

In early Q2 2023 Samsung released their Q1 results and reported losses of 4.58tn won (around £2.8bn)1 from their chip division. It was then that they announced the decrease in IC manufacture to help stem the tide.

What leads to such declines in demand?

There are many factors that can affect demand in this way. Geopolitics plays a role, but recessions are also a big factor in consumer purchasing.

This time the sharp decline in global demand comes after a period of boom for IC manufacturing companies. During COVID-19, with people stuck at home during lockdowns, demand soared for consumer electronics, leading to a global chip shortage.

But once lockdowns ended, and with a shift in global economics, consumers started to cut back, needing to focus instead on essential household spending amid the cost of living crisis.

So, in a way the IC manufacturers went from feast to famine?

In a way yes…Due to the elongated time it takes to manufacture chips in these fantastic multibillion dollar fabrication plants, the production processes can’t just be switched off or cut overnight so they continued to manufacture even though demand may have been low. This led to a period of price downward trend as manufacturers tried to sell products already produced.

For several quarters IC manufacturers were having to sell under cost price. Everything has its limits and they needed to stop losing money. Hence the production cuts.

The news specifically focuses on Samsung. Have the other manufacturers been affected?

100% yes. SK Hynix2, Micron Technology and Kioxia have also been affected and had already cut production before Samsung. However, as the world’s largest IC manufacturer I think everyone was watching for what Samsung would do so that’s why their name comes up more often.

What do the production cuts mean for the memory sector?

6 months on from Samsung’s announcement we are beginning to see the effects of the cuts. Demand is still relatively low for consumer products, but manufacturer stockpiles are beginning to run out and chips are becoming scarcer. With no increase in demands and manufacturers still trying to recoup loses there won’t be an increase in production, so prices are rising.

And for Integral?

With over 30 years’ experience in the industry, we’ve built relationships and market knowledge. We realised there was a potential issue on the horizon.

With careful consideration, we made steps to protect our customers during this difficult and volatile time. We have purchased heavily and increased our stock holding to ensure sufficient stock during the initial period of cuts.

We also made deals with suppliers and have committed to the purchase of stock when it is produced. Due to our robust relationships in the market we’ve managed to ensure we’ll receive stock when others may find this a little difficult.

Finally, what do you think will happen in 2024 and beyond?

For now, I expect to see a continuation of low production and rising prices. Whilst demand is relatively low in the market, IC manufacturers can’t risk increasing production capacity. At some stage you just have to stop losing money so I can see this situation protracting for a while.

That said, the semiconductor industry is an incredibly fast moving and exciting sector where things can and do change quickly; you never know what the next few months may hold for IC manufacturers.

The demand of the coming quarters will be influenced by progress in Artificial Intelligence, continuous development of the Metaverse, more High-Definition devices and the ever expanding use of Cloud Computing.

I expect Integral’s sales to be strong and our customers activity equally so, both due to having adequate stock holdings and to having secured future supplies with our long-standing partners.